NEFT – The transfer of money through national electronic funds (NEFT) is a national payment system that allows funding from one bank to another. With an increased focus on online banking, Neft has become one of the most popular fund transfer methods. It can electronically transfer funds from any banking branch to anyone. He eliminated the need to visit a bank branch to transfer funds.

Table of Contents

What is the NEFT process?

Otherwise, if a person wishes to transfer a sum of money from his bank account to another person’s bank account, he can do it through the NEFT process, instead of removing money, and then to pay for cash, in cash, or writing a check.

The main advantage proposed by Neft is that it can transfer funds from any branch account to any other bank account located anywhere. The only condition is that the sender and receiver branches must be active for Neft.

You can view the NEFT compatible banking list on the RBI website or call your bank’s customer service to confirm the same thing.

The NEFT system also facilitates the unique cross-border transfer of India’s funds to Nepal as part of the Indo-Nepal shipping institutional system.

NEFT Timings

NEFT works on a round base 24 hours a day × 7, 365 days. Previously, net transactions have been available from 8:00 to 18:30 from Monday to Friday only. However, RBI has regulated that Netf trades will be open 24 * 7 every day of the year, including holidays.

In addition, after usual banking hours, NetPT transactions should be automatic transactions using treatment modes (STP) directly by the banks.

How To Transfer Funds By NEFT?

You must follow the procedure below to transfer funds using Neft.

[Step 1]- Log in to your online bank account using your login identifier and password.

[Step 2]- Go to the NEFT Transfer section.

[Step 3]- Add a beneficiary by entering his name, bank account number, and IFSC code.

[Step 4]- Once the beneficiary has been added successfully, you can start a Negot transfer. It is enough to enter the amount to be put back and send.

Who Can Make A NEFT Transaction?

The India Reserve Bank provides a list of participating banking branches, which activates NEFT, which means net transactions can be made on these banking branches. As has already been said, anyone, business or company, which holds a bank account with a participating unit, can make a Neft transfer at any time.

However, suppose a person does not hold a bank account. In that case, it may even make a cash deposit on an NEFT compatible branch, provided that it provides complete details about its address, email identifier, contact number, and more at the bank. These transfers must be of a maximum amount of Rs. 50,000 people.

What Is The Transfer Limit Of NEFT?

There is no upper or lower limit on the amount that can be transferred via Neft. You can start with a Neft transfer with Rs 1. There is only one limitation of the amount of a point transaction via the cash mode, which is RS. 50,000 people.

According to each bank, the schedules and the period of settlement for each transaction could be different. Ordinarily, if funds are transferred to the same bank account, we can expect to receive them in a few seconds. However, when such transfers take place amid different banks, the settlement time could be longer.

asana vs. monday.com – Monday.com combines project and task management with collaboration and basic CRM tools.

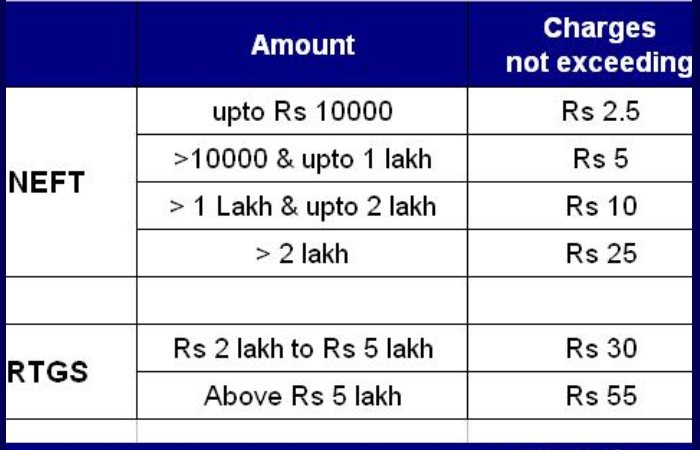

What Are The Charges Applicable To NEFT?

There are no charges in interior transfers, IE, No charge for beneficiaries/beneficiaries

The transfer of funds via Neft initiated online via the Internet / mobile banking channels is not charged.

The transfer fees applicable to the remates are as follows: (TPS excluded)

Firstly, Rs. 2.50 on transfers up to Rs. 10,000

Secondly, Rs. 5 on the transfer of Rs. 10,000 to Rs. 1 Lakh

Rs. 15 on the transfer of Rs. 1 Lakh to RS. 2 Lakhs

Lastly, Rs. 25 On the transfer of more Rs. 2 lakhs

What can you do with the service?

Now that you know what Neft is, it can use the service to make payments for loans, EMIs, credit card contributions, and more. Therefore, the service is not limited to personal fund transfers alone.

Benefits Of Using NEFT

In the process, enter the beneficiary details for the first time, after which you can choose the beneficiary from the list, enter the amount and send.

Take a look at some of the benefits of its transactions that can simplify your daily transactions:

Firstly, no physical presence of one or the other of the parties is necessary to perform a transaction.

Secondly, No physical instrument requests to be transferred at a given moment between the conductive parts to conclude the transaction

Lastly, no visit to the bank is compulsory, as long as a person holds a valid bank account.

The gaps of a physical instrument are easily overcome. It means that it has entirely omitted cases of physical damage of monetary instruments, its flight, or forging

It is simple and effective – this can be done in less than a minute and hardly involves a significant formality. Confirmation of a successful transaction can be quickly received and visualized via email and SMS notifications.

The internet bank can be initiated and conducted from anywhere. IT means that a person does not want to be present-day at a particular place to make transactions for the net. Real-time transactions Ensure both parts.

NEFT vs. RTGS

RTGS represents a real-time gross colony. In this system, the beneficiary bank immediately receives transfer instructions. The regulation is awful, which means that each transaction takes place individually. These costs are final and you can not revoke them.

The difference between Neft and RTGS is that contrary to RTGS, the settlement of funds occurs in lots. You can set time slots for this purpose.

NEFT V/S UPI V/S RTGS

Given below is a detailed comparison between NEFT, UPI (Unified Payments Interface), and RTGS:

| Parameters | NEFT | UPI | RTGS |

| Minimum Transfer Value | Rs. 1 | Rs. 1 | Rs. 2 Lakh |

| Payment Option | [Online and Offline] | [Online] | [Online and Offline] |

| Maximum Transfer Value | No limit | Rs. 1 Lakh | No limit |

| Transfer Time | Min. 2 hours | Immediate | Immediate |

| Service Timing | [Available 24*7] | [Available 24*7] | [Available 24*7] |

| Inward Transaction Charges | [No Charges] | [No Charges] | [No Charges] |

| Details Required | Account No. and IFSC Code | VPA of beneficiary and MPIN | Account No. and IFSC Code |